The national digital currency platform proposed by WingCash in 2016 is now operating for financial institutions as an instant payment network called the Open Payment Network (OPN®). This website has been updated to reflect the current name; however, the original solution proposal remains unchanged. The original proposal, which is available in PDF form includes an executive summary, a detailed description of the solution, and the independent assessment by subject matter experts from McKinsey and Company.

INSTANT PAYMENTS

Open Payment Network™ (OPN) helps financial institutions attract and retain more customers and stay ahead of the competition by enabling them to deliver instant payment services anytime, anywhere. Using OPN’s secure technology platform, financial institutions can deliver cutting-edge services, such as instant mortgage payments, instant payroll processing, instant peer-to-peer payments, multi-currency payments, and more. The OPN platform connects with existing core systems, moving payment value and associated data in real time for safe, secure and immediate settlement. At the application level, the OPN API enables a financial institution to meet or exceed its customer expectations by enabling OPN customers and developers to enhance existing applications with instant payments or to create innovative apps that facilitate instant payments.

INDEPENDENT ASSESSMENT

The Federal Reserve created a team called the Faster Payments Task Force (FPTF) to evaluate proposed payment systems that would use new technology to enable faster payments without sacrificing features, such as security and scalability, that protect the financial networks and are expected by consumers. The FPTF hired experts from McKinsey and Company to perform the assessments. These experts were also called the Qualified Independent Assessment Team (QIAT).

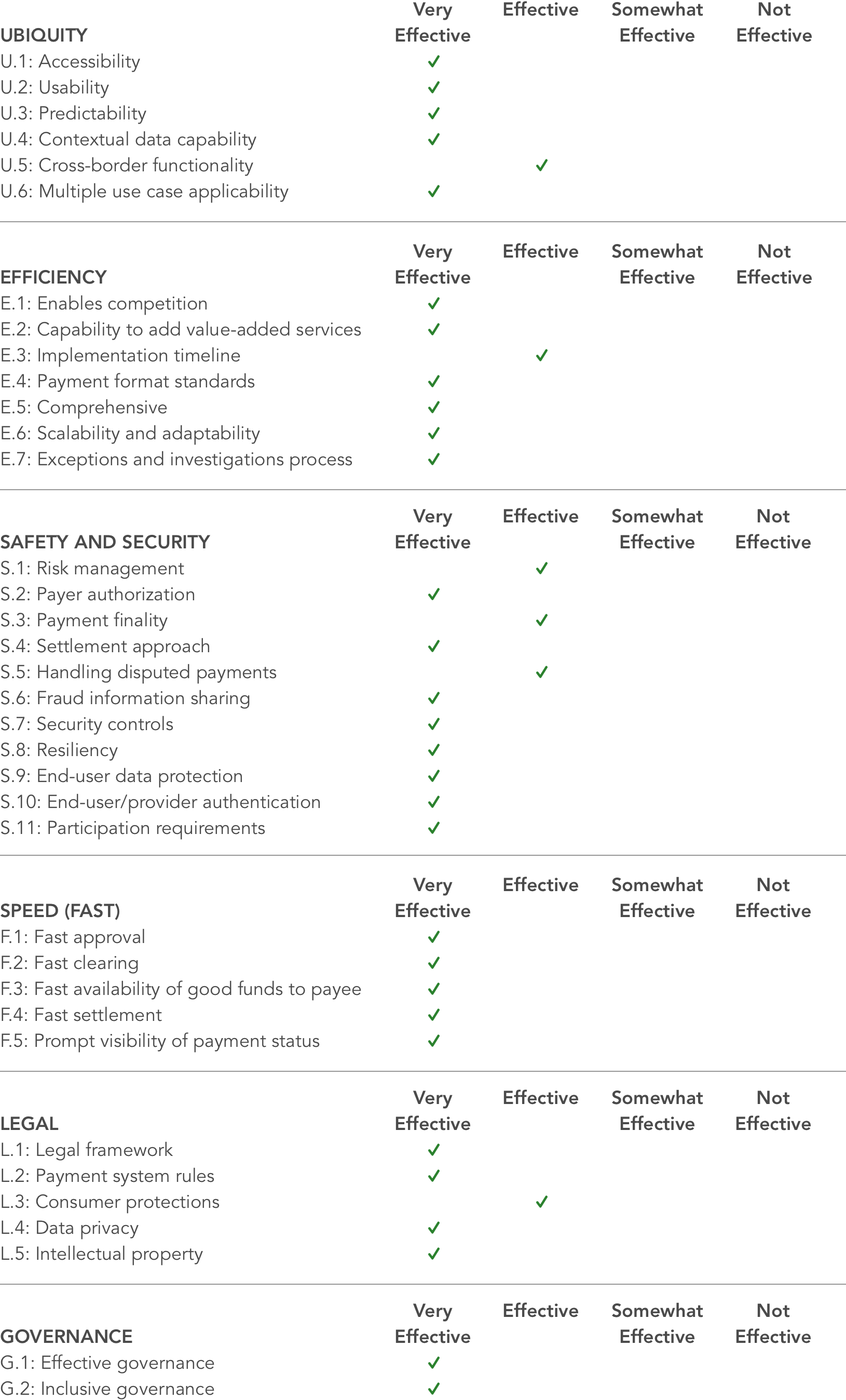

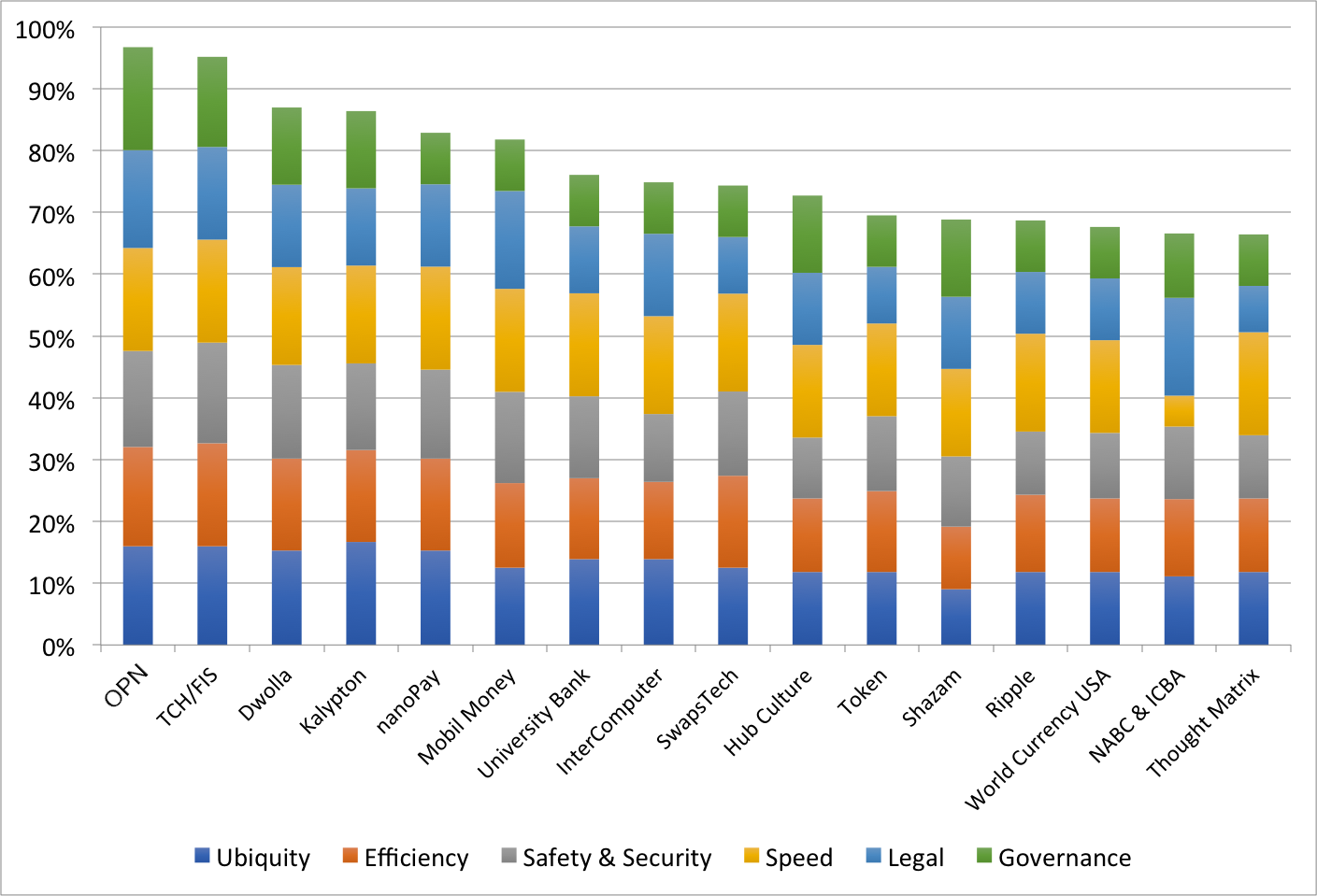

OPN received the highest quantitative score from among the 16 solution proposals assessed by the QIAT as shown in the graphics below.

Source: Modernizing the U.S. Payments System: Faster, Cheaper, and more Secure, August 8, 2017 by Stephen G. Cecchetti and Kermit L. Schoenholtz

Method of Calculation: The authors, Stephen G. Cecchetti and Kermit L. Schoenholtz, constructed the chart to summarize McKinsey’s assessment of the 16 available proposals. For each of the 36 subcategories, they numerically coded the evaluations as follows: Very Effective―4, Effective―3, Somewhat Effective―2, Not Effective―1. They then averaged the scores within each of the six major categories, which they weighted equally in constructing a summary score out of 100.